Price instability has sent shock-waves through the CEA community, with a few even questioning its viability. But we don’t think this is the end, far from it. This could be the driving force for changes akin those seen after the 1970’s twin oil shocks.

Could the Energy Crisis Power a Renewable Future for the Indoor Farming Industry?

Could the Energy Crisis Power a Renewable Future for the Indoor Farming Industry?

India Langley, Food Systems Research & PR | LettUs Grow

People and businesses across the UK and Europe have been watching in apprehension as energy prices continue to soar. These skyrocketing prices result from a perfect storm: rising demand from lifted Covid restrictions, reduced gas stores after a relatively windless summer, record increase in global gas prices, and the war in Ukraine. Reduced gas flow from Russia to the EU, which is as much as 50% reliant, could push prices up around the world; with the wide-reaching impacts felt by individuals and businesses alike.

This price instability has sent shock-waves through the CEA community, with a few even questioning its viability. But we don’t think this is the end, far from it. While talking about the bright side of a crisis may seem crass, this could be the driving force for changes akin those seen after the 1970’s twin oil shocks. “Necessity is the mother of invention”, as they say, and we can see some incredible opportunities for positive change that won’t just help our industry further thrive in the medium-term, but could help support the renewable energy transition too.

In this long-read, we’ll explore the energy landscape we’re working in and what the big opportunities for innovation are. After all, innovation is what the CEA industry does best! (If you’re looking for advice on what to do on your existing farm during this crisis, please read “How can UK vertical farmers power through the energy crisis?”)

Energy usage in CEA

The controlled environment agriculture (CEA) industry is highly sensitive to the price of energy, especially electricity and natural gas. CEA is a catch-all name for methods of growing crops indoors while controlling elements of the environment such as irrigation, temperature, humidity or light. The term includes greenhouses, polytunnels, plant factories, vertical farms and container farms.

Despite CEA’s higher output of produce, and reduced resource, pesticide and land use, a common and understandable critique is that artificially controlling the climate and often replacing sunlight with LEDs requires a substantial amount of energy. Even when prices are stable, energy can be a large proportion of business expenditure. Could this crisis change CEA’s main trade-off, improved productivity and reduced resource consumption for higher energy bills?

For greenhouses that are operating all year-round, energy is usually the second largest overhead after labour. Most of this is spent on gas-fired heating and, in some facilities, using electric lighting to supplement sunlight. The sudden rise in gas prices has severely knocked the traditional greenhouse industry, with many gas-heated greenhouses delaying planting, changing to less energy intensive crops, taking a hit on productivity, or even not planting at all. The Dutch mega greenhouses are using as little as 50% average heat input and this is expected to drop their productivity around 10%. The NFU estimates a 50% drop in UK glasshouse production. At the time of writing, between 60-70% of UK greenhouses in Hertfordshire’s Lea Valley, known as London’s Salad Bowl, are still yet to plant this year. Suffolk’s largest tomato producer, Sterling Suffolk, even ceased production indefinitely, though they were saved weeks after closing.

With plant factories, vertical farms and container farms, electricity rather than gas is the primary energy source. Lighting, temperature, ventilation, irrigation and other operations all typically run on electricity. Lighting is usually the biggest energy expenditure, reaching up to 70% of energy use in some facilities. Electricity’s cost from the grid is also closely tied to the price of fossil fuels. The electricity price climb has raised concerns in the vertical farming community about the future viability of the industry. Unfortunately, if we’ve learned anything from this crisis, it’s that the price of fossil-fuels is more volatile than previously thought. It begs the question: could energy from the grid become cost-prohibitive for some CEA businesses?

Electrification in CEA

In vertical farms, plant factories and container farms, much of the energy inputs have been unified and electrified. Whereas in conventional arable farms, you typically use comparatively little electricity but have a huge amount of hidden energy across the value chain in the fossil fuels used to manufacture synthetic pesticides and fertilisers (the price of which are skyrocketing) to the diesel to power farm machinery and the vast, expansive cold-chain network that enables produce to be shipped and flown around the world.

There are compelling reasons for consolidating and electrifying energy within agriculture:

1). Much like a debt consolidation program, unification makes measuring and keeping track of the energy going into production much easier. Having a clear picture is the first step to minimising the environmental and economic costs

2). More than a third of global electricity comes from low-carbon sources and this percentage is rising year-on-year. The figure for total energy is much lower at only 15.7%, making electricity a much cleaner energy source.

3). Electric power reduces on-farm emissions including particulate matter from the combustion of fossil fuels and nitrogen oxides from fertilisers.

4). Unlike other energy inputs, electricity gives you the opportunity to source from 100% renewables through a 100% renewable tariff. This can help to decarbonise production in CEA farms.

5). The power doesn’t need to come from the grid at all. If using mostly electricity, farms can gain a level of independence from the traditional energy markets, through direct connection with renewable power generators.

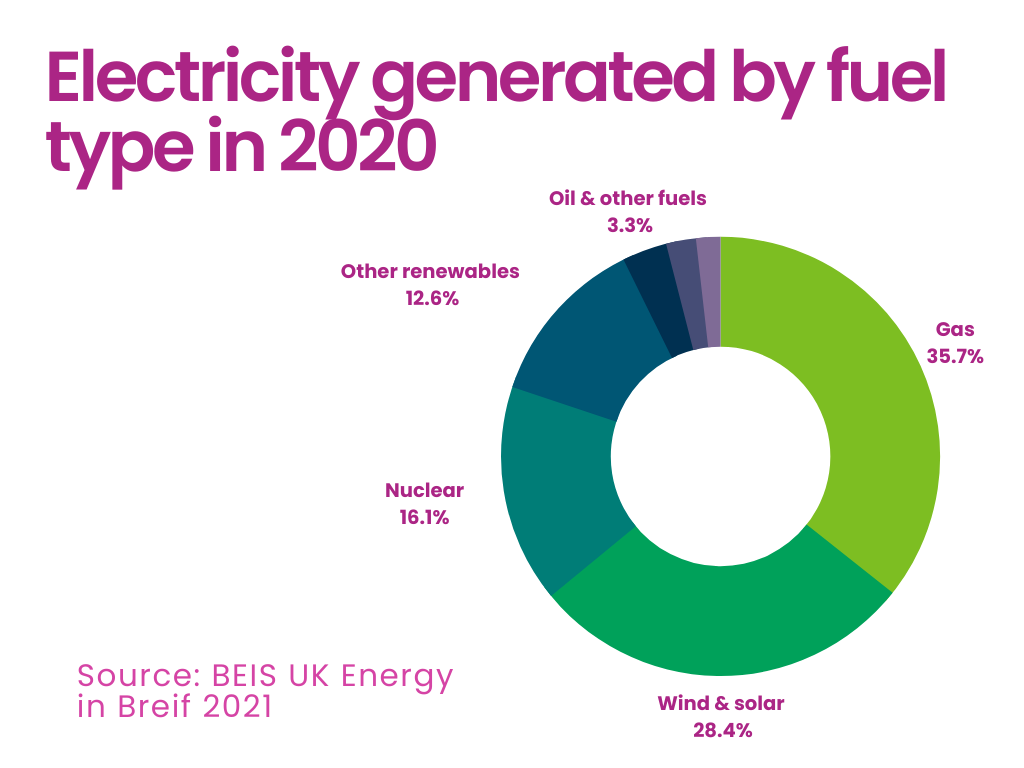

Figure 1. Electricity generated by fuel type in 2020

Source: BEIS - UK Energy in Brief 2021

However, as with anything, there are some drawbacks. The simplicity and transparency of consolidation come at a cost: putting all your eggs in one basket. It’s this issue that makes the vertical farming industry so sensitive to price shocks in retail energy markets. The other issue we should not shy away from is that, while the grid has the potential to be 100% renewable, we’re not there yet. According to BEIS the 2020 breakdown of electricity generated by fuel type is still only 43.2% renewable (Fig 1), and 100% renewable tariffs can come at a premium. The proportion of this mix is very important for the sustainability profile of vertical farms, which are closely tied to the amount of renewable energy used, but we’ll get to that later.

Don’t forget, this is a fossil fuel crisis

It’s important to remember that the recent electricity price instability is largely the product of a fossil fuel market crisis. For a long time, renewable sources of energy have been perceived as more volatile because they fluctuate with weather conditions like how much the wind is blowing. Whereas fossil fuels, while finite and damaging, have been viewed as more stable and reliable. However, what we’re seeing now is that, in the long-term, the opposite is true. Yes, we may see short-term fluctuations in renewable sources from day to day, month to month and season to season. However, the sun will always shine, the wind will always blow and the tide will beat on ceaselessly. It’s this long-term stability that allows renewable energy projects to be financed over 20 year periods. Whereas, because fossil fuels are finite and their markets are so closely tied to geopolitics, history and recent events show that their instability is all but assured.

Renewables may be the answer, but it won’t be easy

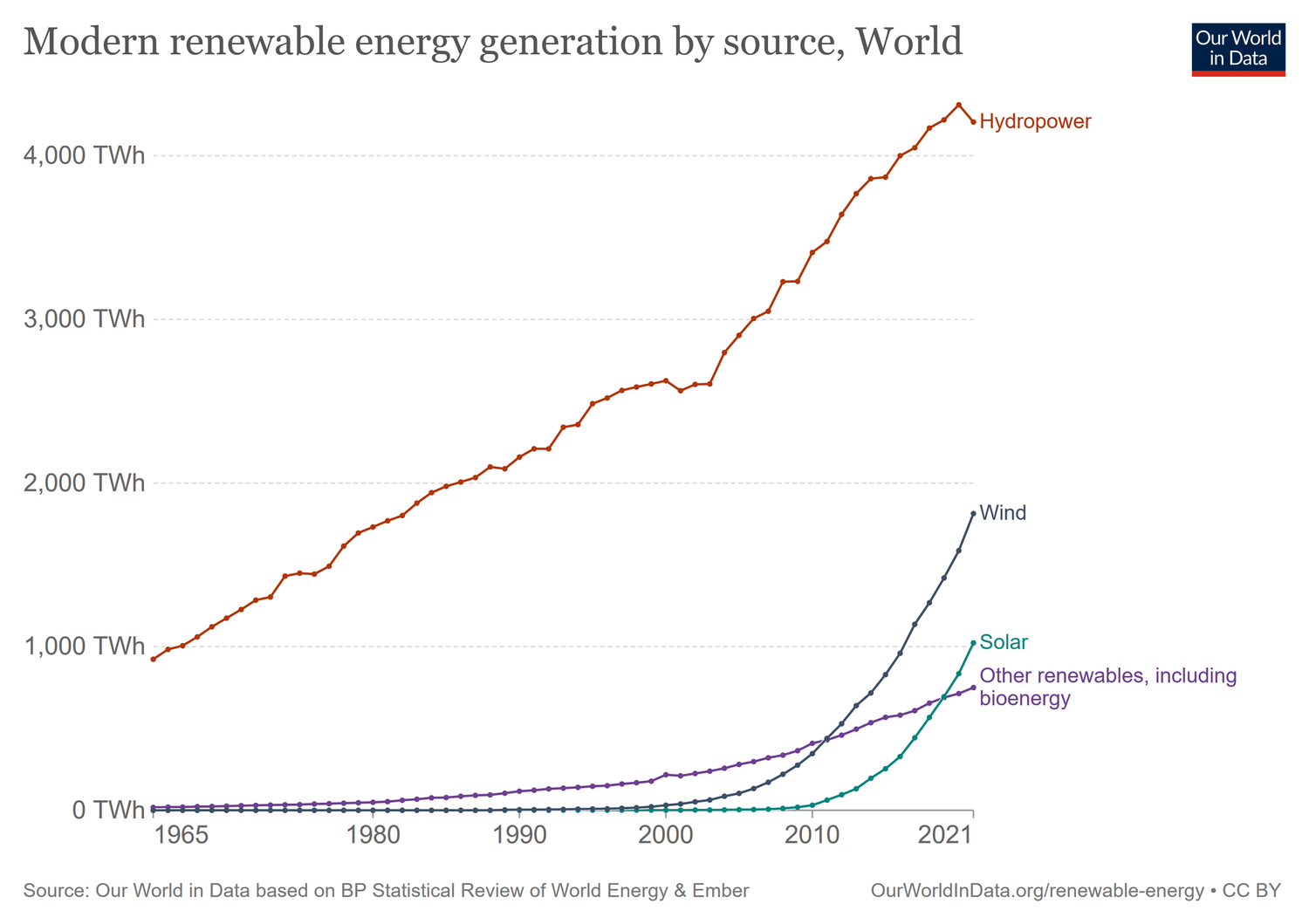

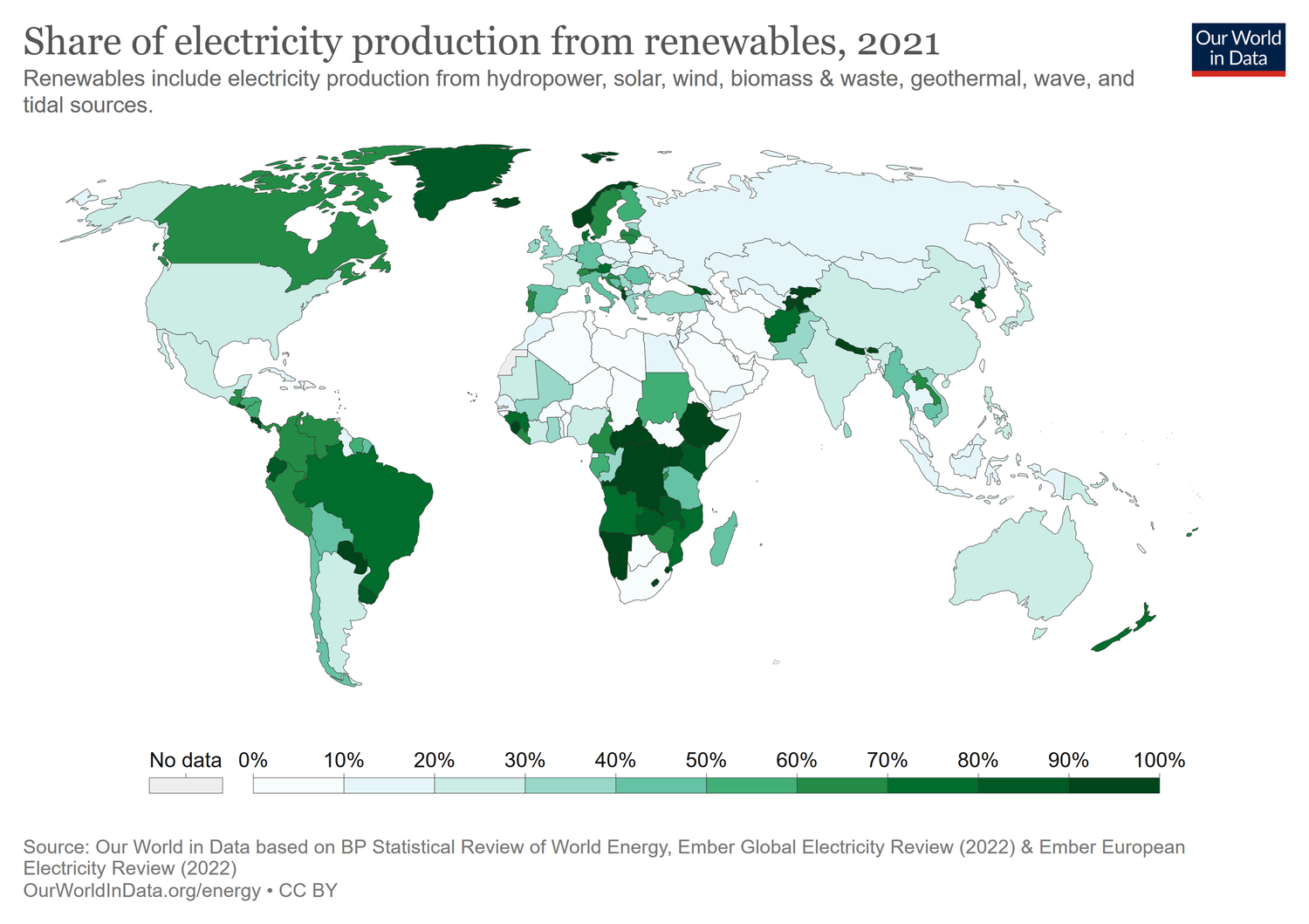

The amount of energy produced by renewable sources is growing rapidly both in the UK (Fig 2) and globally (Fig 3). And Russia’s attempts to weaponise energy could further speed up the energy transition in the EU. The UK has pledged for the energy in the national grid to come from 100% renewable sources by 2035, Germany’s pledged the same by 2045, and a growing number of countries are close or already there (Fig 4).

None of this is to say that the renewable energy transition will be easy or risk-free. Quite the contrary, the transition from a fossil-fuel based network to a zero-carbon one is likely to be fraught with difficulties, especially for the grid. One major issue countries need to overcome is the fine balance that must be struck between supply and demand. The intermittent nature of renewable generation makes this challenging. One solution is introducing flexibility via “demand-side response”. In its simplest form, demand-side flexibility is a service that smooths out peaks and troughs by allowing energy users to either turn electricity usage “on” to relieve pressure or “off” to reduce demand during times of system stress. This can empower distribution system operators to cope with the new challenges brought on by the energy transition. The bigger the energy user and the more flexibility they can provide, and the higher value their offering; meaning that CEA is in a prime position to offer flexibility. This mutually beneficial relationship between renewables and CEA is exactly why we’ve partnered with Octopus Energy.

26f7.png)

Renewable energy & CEA sustainability

Securing renewable energy and potentially decoupling from the grid will provide more price stability for CEA facilities than previously thought. While this is undoubtedly going to be an uncomfortable time for the industry, it could be just the push it needs to accelerate making renewable energy use standard practice, rather than waiting for governments to meet their Net Zero goals. Addressing energy is not just important to protect against economic shocks, the type of energy used to power a controlled environment farm is pivotal for its sustainability profile. Take our DROP & GROW container farm as an example. It would emit just 0.39 kg CO2eq. per 1 kg pea shoots if running on 100% renewable energy. However, this increases 290% to 1.52 kg CO2eq. per 1 kg if using a standard non-renewable UK energy tariff on the 2021 grid mix. None of this is to say that sustainability is all about carbon emissions. Far from it; while CEA can hugely cut the carbon emissions associated with fresh produce, it’s its biodiversity benefits and resource saving capacity that really set it apart from other forms of agriculture.

Opportunities for innovation in CEA

This energy crisis calls for innovation; the status-quo will no longer cut it. But if there is one thing the CEA industry is good at, it’s innovating. This issue needs to be tackled from all angles: making systems more energy efficient, stabilising supply, and reshaping the supply-demand relationship to benefit everyone. Now is the time to look outside of ourselves and harness that “change the world” energy at the core of CEA to support the renewable transition.

Technology improvements

The first, and most obvious step is to tighten our belts by maximising energy efficiency. A 2021 literature review of energy efficiency in multiple CEA systems published in the journal Renewable and Sustainable Energy Reviews, highlighted several technical opportunities to improve the energy efficiency of CEA systems. The authors, Engler & Krarti, break these down into a few main areas where innovation could be most impactful. Together they could reduce energy consumption up to 75%. These main points are architectural changes, energy generation, HVAC and lighting. The review also invites further research into control technology, dehumidification and breeding crop varieties for lower energy consumption.

Distributed energy generation & microgrids

Distributed energy generation refers to renewably generating electricity either at or close to where it will be used, through technologies such as solar panels or wind turbines. This energy can either directly power the owner’s business or it may connect to a microgrid; a small collection of electricity users with a local energy source. Microgrids are able to operate independently but are also attached to the national grid. Because of this, a microgrid can isolate itself from the grid to run independently on the energy generated and stored. Together they can reduce the environmental impacts of electricity usage by reducing how much energy is produced at centralised power plants, limiting energy wastage during transmission and distribution, and helping to support fuel switching. Some forms, like combined heat and power, can capture energy that might otherwise have been lost.

A specific benefit of microgrids is they can help introduce flexibility by isolating from the grid when it's under stress due to high demand. Big energy users like large CEA farms can benefit hugely from direct connection. Linking up with distributed renewable sources to gain long-term fixed-price energy contracts would insulate farms from changes in price on the national grid. This could have some important benefits alongside price stability. It provides the security that when national energy levels fluctuate you've got access to and control of your own energy supply, and can guarantee a low and long-term price for your energy. Both Fifth Season and Bowery Farms are big advocates of the benefits of microgrids.

Co-location of CEA with renewables

Similar to distributed energy generation, another important step-forward for energy-usage in CEA will come from co-location of renewables with food production. Co-location takes a holistic approach to the energy-food nexus through the deliberate production of food and energy in a single location. It’s been trialled with really positive results for outdoor agriculture and co-locating electric vehicle charging infrastructure (EVCI) is already being explored to some success. However, CEA combines the best of both worlds: the more secure revenue streams of food production with a predictable and high, yet flexible, energy demand. This means that CEA could overcome issues holding back co-location with EVCI while still providing its demand-side benefits. In fact, there are already plans to co-locate a new solar farm with the Food Enterprise Park - a 46-acre food production site in Norfolk that will soon be home to ‘Norfolk's largest vertical farm’. This isn’t a new concept, La Serra, who we’ve partnered with for aeroponic tomato propagation trials, co-located with solar alongside their new glasshouse. Another brilliant way co-location can address energy usage in CEA is through direct renewable or waste energy sources such as geothermal energy or waste heat. Low Carbon Farming have built two of a planned 41 glasshouse sites that will be heated by waste heat from nearby recycling centres and we could soon see over half of the heat demand for the greenhouse sector in the Netherlands be met with geothermal energy. It may not come as a surprise to many in the CEA industry that the Dutch are leading the way here.

The flexibility market

Perhaps most exciting, co-location offers the opportunity to make the most of the burgeoning flexibility market. As a greater number of renewable and distributed energy generation systems are added to the network (and the demand for electricity can be extended to new industries like transport or farming), many distribution system operators are starting to include flexibility in their operational strategies. A great example of a company making waves in this space is Piclo Energy, which simplifies procurement for system operators sourcing energy flexibility. Because of their heavy and reliable load, co-location of CEA farms with renewable energy production can help offer a significant amount of local flexibility through demand-side response in return for a cheap fixed-price energy contract. This isn’t just good for the farms decoupling from the grid, it’s advantageous for the energy generators too. A great example of this on the horizon is Flexfarming’s “Farm as a Battery” (or FAB) idea that enhances the grid’s clean generation and storage capacity.

The solar powered light at the end of the tunnel

With the current energy crisis, now may seem like a difficult time for CEA. We’re not suggesting that this is going to be a comfortable transition, but it could actually be a positive turning point for the industry. The rising price of fossil fuels and their increased volatility should force CEA to innovate and live up to its highest sustainable ideals. Committed investment into renewables integration will not only provide stability for CEA farms but will also improve their environmental profile and could even help smooth out some of the foreseen issues in the energy transition, making the change easier for everyone. This crisis could be just the push the industry needs to achieve what it set out to do from the very beginning - reduce the environmental impacts of growing fresh produce. This isn’t the end for CEA, quite the contrary, it could be the making of the industry.

The content & opinions in this article are the author’s and do not necessarily represent the views of AgriTechTomorrow

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product